Terms of Use

Disclaimers

Government Required Risk Statement:

Futures, FOREX, stock, and options trading is not appropriate for everyone. There is a substantial risk of loss associated with trading these markets. Losses can and will occur. No system or methodology has ever been developed that can guarantee profits or ensure freedom from losses. No representation or implication is being made that using any of the information provided will generate profits or ensure freedom from losses.

CFTC Rule 4.41:

HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Trading performance displayed herein is hypothetical. Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance trading results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses is material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

The risk of loss in trading can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. If you purchase or sell Equities, Futures, Currencies or Options you may sustain a total loss of the initial margin funds and any additional funds that you deposit with your broker to establish or maintain your position. If the market moves against your position, you may be called upon by your broker to deposit a substantial amount of additional margin funds, on short notice in order to maintain your position. If you do not provide the required funds within the prescribed time, your position may be liquidated at a loss, and you may be liable for any resulting deficit in your account.

Under certain market conditions, you may find it difficult or impossible to liquidate a position. This can occur, for example, when the market makes a "limit move." The placement of contingent orders by you, such as a "stop-loss" or "stop-limit" order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders.

AlphaDroid ETFs

Bull Market Leaders. Bear Market Exits.Seeking to Deliver the Benefits We Believe Investors Want Most:

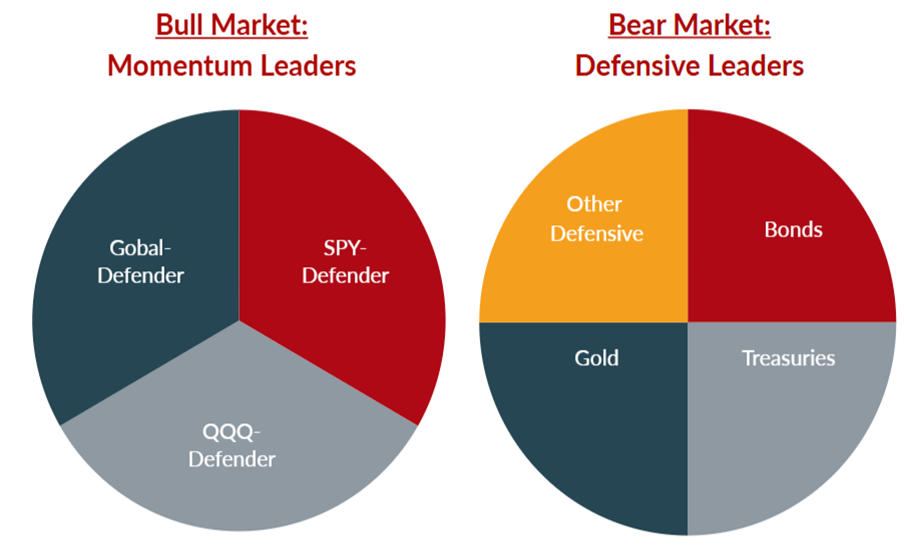

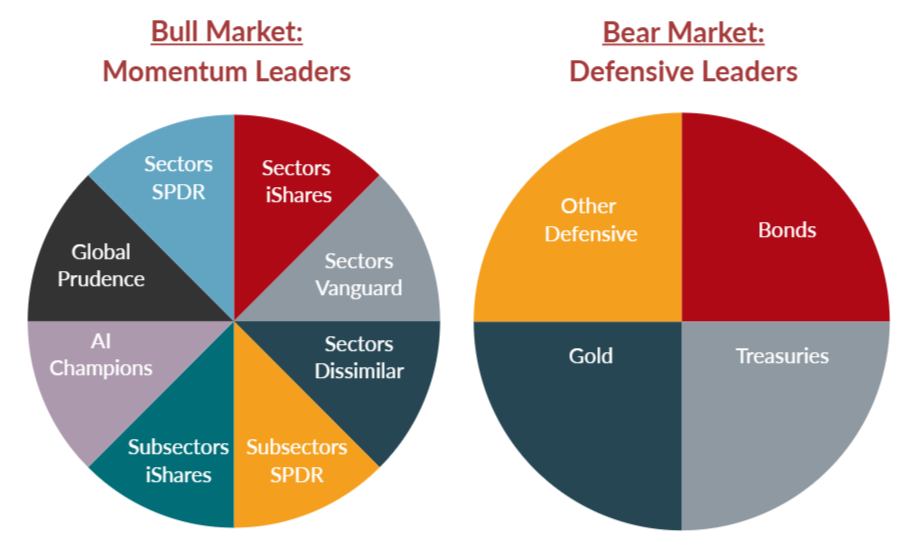

1. Momentum Leaders in Bull Markets.

2. Defensive Leaders in Bear Markets.

3. Tax deferral in taxable accounts.

4. Automated trading: free up time for what matters most.

Exposure to AlphaDoid Strategies in a Tax-Deffered Structure

EZMO

Risk-Mitigation Momentum Strategy + Tax-Deferred Structure

EZRO

Tactical Risk-Managed Growth + Tax-Deferred Structure

Frequently Asked Questions

Who might consider these ETFs?

Investors seeking adaptive, rules-based strategies may find EZMO and EZRO appealing. Each involves risk, including possible loss of principal. Review the prospectus before investing.

Are there tax advantages?

The ETF structure allows trades within the fund to occur in-kind, potentially deferring taxable events until shares are sold. Tax outcomes vary—investors should consult a tax advisor.

How often do the funds adjust their holdings?

The AlphaDroid Indexes typically evaluate and adjust their ETF holdings monthly based on updated market data and signals from the proprietary models.

Are these funds designed to be long term portoflio holdings?

Yes. Because they tactically adjust to market conditions, both EZMO and EZRO may be appropriate long-term holdings in a portfolio.

Where are EZMO and EZRO listed and how can they be purchased?

Both ETFs trade on Nasdaq under the tickers EZMO and EZRO. They can be bought and sold through most brokerage accounts, just like other publicly traded ETFs.

Learn More About AlphaDroid Indexes

For more insights on the AlphaDroid Indexes please click below.

Important Disclosures and Risks

Momentum Leaders: “Momentum” refers to an investment strategy that seeks to identify securities demonstrating recent price strength, with the expectation that upward or downward trends may continue for a period of time.

Defensive Allocations: “Defensive allocations” typically include asset classes or positions that may be less sensitive to broad market declines, such as cash, short-term bonds, or low-volatility equity holdings. These allocations do not eliminate the risk of loss.

There is no guarantee the strategy will be successful in limiting losses during periods of market decline. All investments carry risk, including the risk of loss of principal.

An investor should consider the investment objectives, risks, charges, and expenses of the Fund carefully before investing. The prospectus and, if available, the summary prospectus contain this and other information about the Fund. You may obtain a prospectus and, if available, a summary prospectus by calling 877-376-0082 or visiting www.alphadroidetfs.com. Please read the prospectus or summary prospectus carefully before investing.

The Funds are recently organized investment companies with a limited operating history. As a result, prospective investors have a limited track record or history on which to base their investment decision.

Investing involves risk, including the possible loss of principal. In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles, or from social, economic, or political instability in other nations. Bonds and bond funds are subject to interest rate risk and will decline in value as interest rates rise. Investments in commodities are subject to higher volatility than more traditional investments. The underlying funds may invest in derivatives, which are often more volatile than other investments and may magnify the Fund’s gains or losses. The use of leverage by the underlying fund managers may accelerate the velocity of potential losses. The Fund may frequently buy and sell investments. Higher portfolio turnover may result in the Fund paying higher levels of transaction costs and generating greater tax liabilities for shareholders. Portfolio turnover risk may cause the Fund’s performance to be less than you expect.

The risks of investing in securities of ETFs, ETPs and investment companies typically reflect the risks of the types of instruments in which the underlying ETF, ETP or investment company invests. In addition, with such investments, the Fund bears its proportionate share of the fees and expenses of the underlying entity. As a result, the Fund’s operating expenses may be higher, and performance may be lower. All fees and expenses are outlined in the Fund’s prospectus.

Exchange-traded funds (ETFs) trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETF's net asset value (NAV), and are not individually redeemable directly with the ETF. Brokerage commissions and ETF expenses will reduce returns.

The Fund is non-diversified, which means that it may invest more of its assets in the securities of a single issuer or a smaller number of issuers than if it was a diversified fund.

The Fund seeks to track the performance of an index, which may result in lower returns than if the Fund were actively managed. Passively managed funds are subject to tracking error risk, which is the chance that the fund's performance will deviate from the performance of its target index and may be heightened during times of increased market volatility or under other unusual market conditions.

The Index relies on a quantitative model that utilizes artificial intelligence as well as third-party data and information to select Underlying ETFs. To the extent the model does not perform as designed or as intended, the Fund’s strategy may not be successfully implemented, and the Fund may lose value.

For a complete description of the Fund’s principal investment risks, please refer to the prospectus.

Teucrium Investment Advisors, LLC, wholly owned by Teucrium Trading, LLC, serves as the investment adviser and PINE Distributors LLC is the distributor for the AlphaDroid Broad Markets Momentum ETF. PINE Distributors LLC is not affiliated with Teucrium Trading, LLC and Teucrium Investment Advisors, LLC.